Recycling Markets Soar, Is it Good For Zero Waste?

When China banned the import of mixed paper and mixed plastics in 2018, many people lost faith in recycling. To this day, stories still circulate that there are no markets for recyclables and that it's a sham. While there are certainly still significant issues that need to be addressed in recycling (like glass as landfill cover and plastics to chemical "recycling"), there is no question that the material picked up at the curb is in high demand by manufacturers and that markets have rebounded and in some cases, are at record highs.

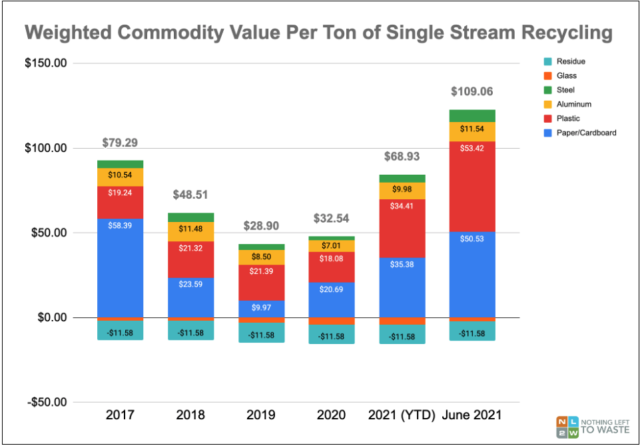

As you can see, 2018-2020 were a rough few years for recyclers. But as investments in domestic paper processing grew, and demand for recycled content for plastics increased, the value of those materials have soared. As of June, 2021, a typical mix of recyclables in a single stream program is worth more than $109/ton, up from $79/ton pre national sword. No one knows how long these prices will last, and it's likely a market correction will eventually occur, but it's safe to say that the days of stockpiling recyclables are behind us for now.

The graph shows the weighted value each commodity contributes to a typical ton of single stream recycling at the curb. This allows you to see how the relative value of each commodity impacts the overall economics of the recycling program. Aluminum and steel have been fairly stable throughout the last 5 years. You can see that paper and cardboard (blue) was at its highest in 2017, when China was accepted fairly contaminated loads of mixed paper at very high prices. At the time, domestic mills couldn't compete or afford to upgrade their systems to handle this stream at the levels of contamination. Once China was out of the market, significant investments were made in both cleaning up the paper stream at the MRF (and the curb) and in the building of domestic paper mills. These are good things, better for the environment, our local economy and the long term stability of recycling.

The other interesting trend is with the value of plastics. Plastics currently represent almost 50% of the value of a ton of recycling (compared to 25% in 2017). When paper markets tanked in 2018-2020, plastic values really kept things afloat. From a zero waste perspective, the question is, if market value for plastics remain high, how will this impact the movement to reduce and replace single use plastics. Even with recycling, currently less than 2% of plastic bottles are made back into new bottles. I believe this misalignment in the financial and environmental goals of zero waste is something to closely watch as MRFs become to rely on the value that plastics bring.